Funding for the final phase of campus renovations funded through Measure G is on the table as the deadline for approval looms.

At their Feb. 4 meeting, the Citrus College Board of Trustees discussed the issuance of Series 2014D Bonds, the fourth set of bonds issued following the approval of Measure G, passed by voters in March 2004.

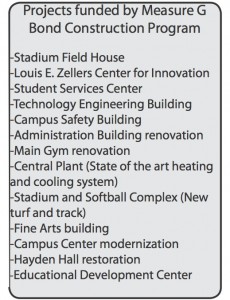

Measure G authorized the sale of $121 million in bonds to upgrade campus safety and security, expand academic facilities, and construct classroom buildings, science labs and student support facilities.

Measure G authorized the sale of $121 million in bonds to upgrade campus safety and security, expand academic facilities, and construct classroom buildings, science labs and student support facilities.

Issuance of this set of bonds would raise approximately $29 million, which would be used to finance renovations of the Campus Center, the Educational Development Building and Hayden Hall, as well as the construction of a Fine Arts Building.

Most of the Series 2014D Bonds would be issued in the form of capital appreciation bonds (CABs) or convertible capital appreciation bonds (CCABs).

CABs have no installment payments with interest compounding until payments become due at a later maturation date, often times decades later. By contrast regular bonds require interest payments be made over time, usually semi-annually.

CABs have drawn criticism from media and taxpayers alike after many California schools districts abused their use of CABs. In some instances, districts will end up owing up to 10 times the amount they borrowed, according to the Los Angeles Times.

The California State Legislature recently passed Assembly Bill 182 in response to the misuse of CABs. It limits all CABs to a maximum of 25 years and 8 percent interest, requires that issuance of any bonds goes before the board of trustees twice, and also establishes a more extensive review of bond sales.

In the resolution under consideration by the Citrus BOT, the structure of the CABs and Convertible CABs complies with the new restrictions included in AB 182.

The maximum maturity of the 2014 bonds will be 25 years from the date of issuance.

CABs are under consideration because the District is unable to issue many current interest bonds due to the restrictions of Prop 39.

The District is not able to utilize current interest bonds for the Series D issuances because there is not enough capacity to pay interest in the early years and stay under the $25 legal tax rate maximum, according to RBC Capital Markets which serves as underwriter for the Citrus Community College District.

The total amount of debt to be repaid under the 2014 bonds is estimated to be $49,840,050 or less, with the District receiving up to $18,996,566 in proceeds of sale of the 2014 Bonds, resulting in a payback ratio of 2.62 to 1.

This ratio falls well below the established 4 to 1 payback ratio required in AB 182.

The Citrus Community College District has already issued nearly $92 million of Measure G bonds for the construction and renovation of several buildings, infrastructure upgrades, and technological improvements.

The Fine Arts building has been approved by the Division of State Architect (DSA), with a time limit of mid-2014 for the start of the project. If construction is delayed beyond mid-2014, the project will have to essentially be started over, costing additional time and money.

The Board of Trustees will meet March 18 at 4:15 p.m. to consider taking action on this issue. The meeting is open to the public.